Cash-strapped unicorns have three choices: raise additional capital in the private markets, merge or be bought out; move into the public markets.

Vitalik Buterin, the man behind ethereum, talks crypto and the U.S. crackdown

The Russia-born coder, who built ethereum in his late teens, doesn’t stay long in one place anymore. Meanwhile, the list of places he won’t go keeps growing.

New York is a tech startup hotbed after almost a decade-long run of IPOs

New York’s successful tech entrepreneurs are helping the next generation raise capital for emerging startups

Scooter company Bird delisted from NYSE after stock collapse, will trade over the counter

Once valued at $2.5 billion by private investors, scooter company Bird is moving its stock off the New York Stock Exchange after the shares collapsed

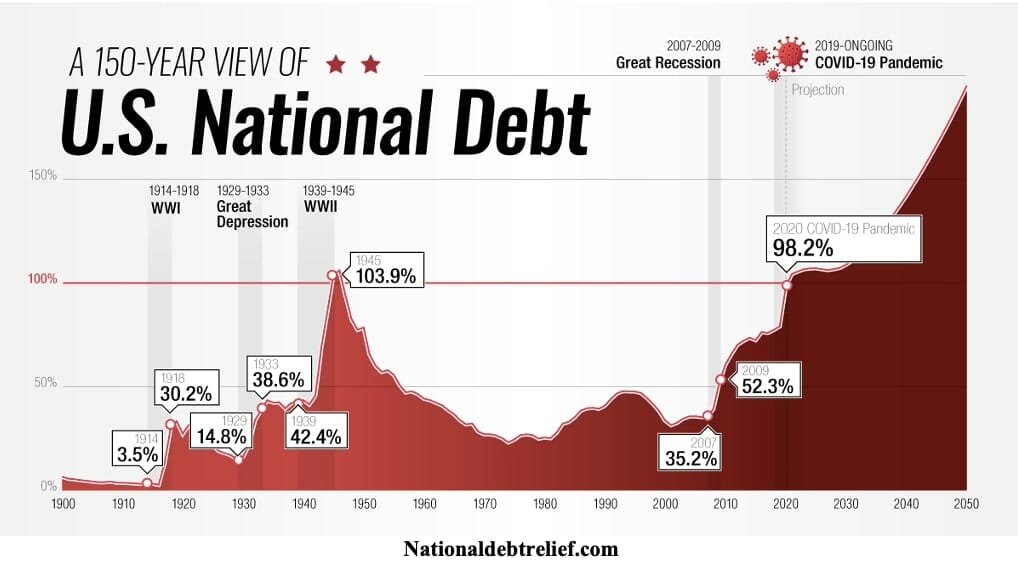

Rising National Debt, Fewer Workers And Slower Growth Since 2001 – Why?

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary: Something more dramatic than the loss of 3,000 American lives happened on September 11, 2001. We seem to have lost our nerve and taken leave of our financial senses. We launched a series of costly wars in Afghanistan and Iraq (with incursions elsewhere) and passed...

Cryptocurrency Is Still Revolutionizing Fundraising

The state of fundraising is undergoing a significant transformation with the advent of cryptocurrency. Traditional methods of raising funds often involve lengthy processes and intermediaries, leading to inefficiencies and delays. The emergence of cryptocurrency, however, has transformed the landscape by providing a streamlined and decentralized approach. Cryptocurrency enables individuals and organizations to raise funds directly from global participants without the...

Electric Vehicles And Green Deals Are Now At The Center Of The Political Debate – And It’s Not For Good Reasons

Despite experiencing record sales during much of the first half of the year, electric vehicles (EVs) are now being pulled to the center of the political debate, as the run-up to the 2024 presidential election begins to intensify. During the second quarter of the year, a record-shattering 300,000 fully electric battery-operated vehicles hit American roads, according to Cox Automotive, a...

Adobe’s New Products, Pricing Overshadow FQ3 Earnings

Adobe (NASDAQ:ADBE) shares traded modestly lower in early Friday trade after the software company reported results for its third fiscal quarter. While Adobe’s FQ3 earnings came in just ahead of the average analyst estimate, as well as revenue guidance, it seems that investors were more encouraged by this week’s announcement about new GenAI products and the attractive pricing. Moreover, the...

S&P 500 Slides – Absorbing Interest Rate Shock

S&P 500 and all its sectors slid yesterday without as much as a brief visit to 4,420s at the open – straight down through yesterday given 4,385 premium level, with Russell 2000 showing no signs of life. 10y yield of 4.50% has been reached, risk assets repricing is underway, and this is how I view the upcoming yield path, including...